Empowering Your Adjusters and Improving Your Bottom Line

ClaimExpert, our flagship claims processing solution, automatically processes 68% of incoming medical bills and non-medical documents with no user intervention.

ClaimExpert contains rules for over 190 different document types, quickly handling whitemail and any other documents that come across your adjuster’s desk. By offering unparalleled workflow management, we reduce the cost spent on claims management and provide greater efficiency, consistency, and document transparency.

By removing routine tasks, ClaimExpert lets adjusters focus on complex claims, which allows them to close medical claims 50% faster than their counterparts using manual claims management.

65% Auto-Adjudication

Automatically processes incoming documents with NO adjuster intervention

Serious Bottom-Line Results

Clients typically see between 11 and 23 points medical loss improvement in the first year

Free Reserves Faster

Adjusters using ClaimExpert closed medical claims over 50% faster, freeing up reserves

More Than Bills

ClaimExpert contains rules for over 190 different document types, quickly handling whitemail and any other documents that come across your adjuster’s desk

ClaimExpert automatically processes 65 percent of incoming medical bills and non-medical documents with no user intervention. Documents requiring adjuster intervention are flagged and sorted for easy review and straightforward decision-making.

How Can ClaimExpert Help You Reduce Costs?

Learn More About ClaimExpert

Related Services

APS provides numerous services that can be incorporated into ClaimExpert, but can also improve your claims processes separately as standalone upgrades.

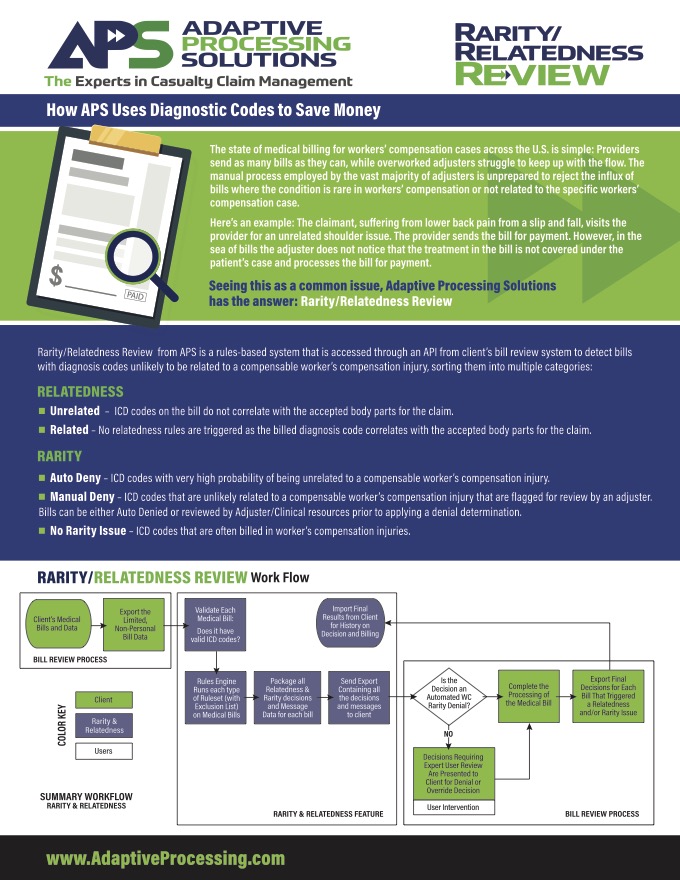

ODG Scoring

APS has partnered with MCG Health to embed their Official Disability Guidelines (ODG) into our systems. This integration continually cross-references claims against the ODG knowledge base to determine if claims are performing accurately and notifies adjusters when action is required.

By using these evidence-based guidelines, you can get your claims and spending under control.

ODG Scoring is integrated in ClaimExpert and is available as a standalone upgrade to enhance your claims operations.

The power of APS’ business rules and workflow automation tools coupled with ODG’s comprehensive guidelines.

States adopting ODG have seen huge reductions in medical costs, lost time/disability, treatment delays and premiums.

Claims are continuously monitored against guidelines, if anything is out-of-the-ordinary adjusters will know.

Check out our ODG Overview and download an easy one-page summary of the tool.

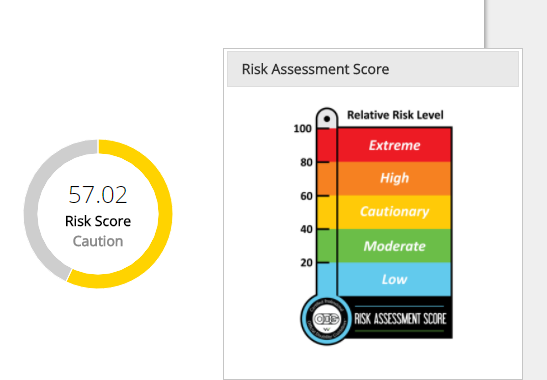

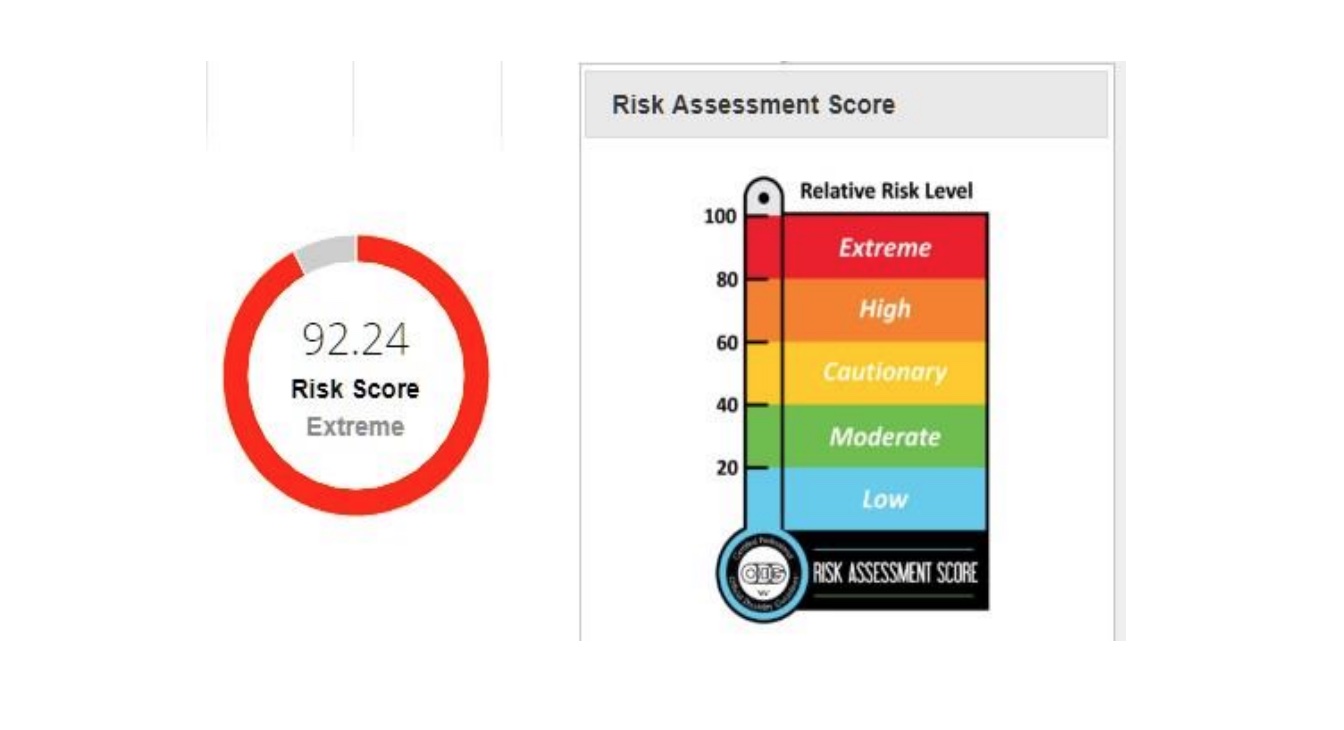

Relative Risk Level

From MCG Health: Every claim is assigned a Risk Assessment Score (RAS), which changes as claim characteristics and comorbidities are added. The higher the score, the more closely adjusters should pay attention.

Taking an evidence-based approach to ensure successful claims management

- Evidence-based treatment and return-to-work guidelines are applied to claims.

- Automatically flags services that exceed best-practice

recommendations or user-defined allowances. - Identifies claims that may be candidates for nurse case management, triggering a referral if necessary.

- Identifies potentially problematic claims early on, saving money and time.

- Assists with reserve oversight, and takes the guesswork out of reserve setting.

- Automatic and pre-populated referrals save adjusters time and reduce errors.

- Embedded directly into our systems, changes in ODG scoring or best practices are automatically reflected in the user interface.

- Claims are continuously monitored against guidelines.

Referral Tool

Using indexed data, the APS Referral Tool pre-populates and automatically sends referral requests to negotiated partners, allowing you to maximize your network penetration.

The APS Referral Tool is integrated into ClaimExpert and is available as a standalone upgrade to enhance your claims operations.

- Pre-populated forms save time and avoid potential errors.

- Maximizes network penetration.

- Status check-in ensures claims are staying on track.

Embedded directly into our systems, user selection of a specific partner

- Network presents the appropriate and agreed-upon services offered by that partner.