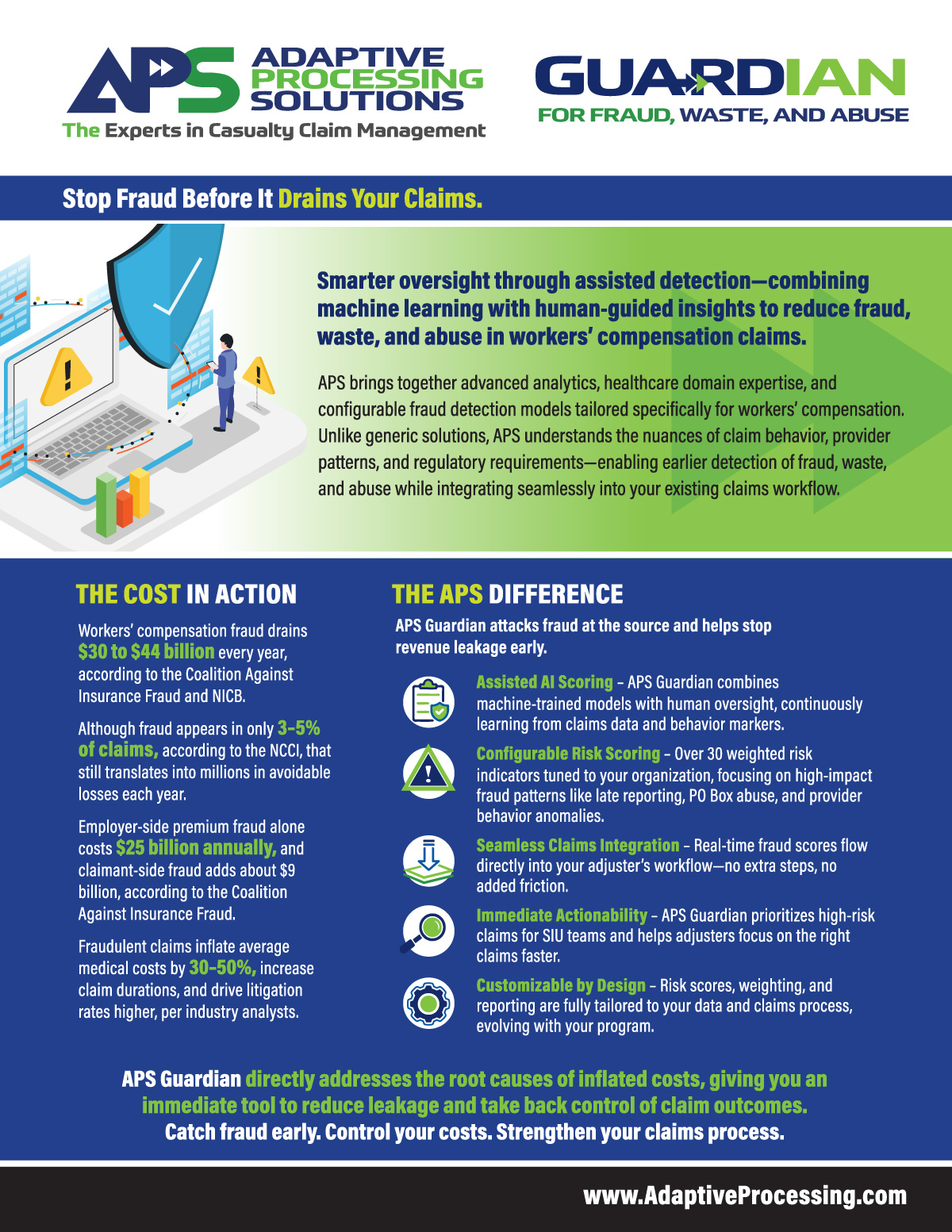

Stop Fraud Before It Drains Your Claims.

Smarter oversight through assisted detection—combining machine learning with human-guided insights to reduce fraud, waste, and abuse in workers’ compensation claims.

APS brings together advanced analytics, healthcare domain expertise, and configurable fraud detection models tailored specifically for workers’ compensation. Unlike generic solutions, APS understands the nuances of claim behavior, provider patterns, and regulatory requirements—enabling earlier detection of fraud, waste, and abuse while integrating seamlessly into your existing claims workflow.

The Cost in Action

Workers’ compensation fraud drains $30 to $44 billion every year, according to the Coalition Against Insurance Fraud and NICB.

Although fraud appears in only 3–5% of claims, according to the NCCI, that still translates into millions in avoidable losses each year.

Employer-side premium fraud alone costs $25 billion annually, and claimant-side fraud adds about $9 billion, according to the Coalition Against Insurance Fraud.

Fraudulent claims inflate average medical costs by 30–50%, increase claim durations, and drive litigation rates higher, per industry analysts.

APS Guardian directly addresses the root causes of inflated costs, giving you an immediate tool to reduce leakage and take back control of claim outcomes. Catch fraud early. Control your costs. Strengthen your claims process.

The APS Difference

APS Guardian attacks fraud at the source and helps stop revenue leakage early.

Assisted AI Scoring – APS Guardian combines machine-trained models with human oversight, continuously learning from claims data and behavior markers.

Configurable Risk Scoring – Over 30 weighted risk indicators tuned to your organization, focusing on high-impact fraud patterns like late reporting, PO Box abuse, and provider behavior anomalies.

Seamless Claims Integration – Real-time fraud scores flow directly into your adjuster’s workflow—no extra steps, no added friction.

Immediate Actionability – APS Guardian prioritizes high-risk claims for SIU teams and helps adjusters focus on the right claims faster.

Customizable by Design – Risk scores, weighting, and reporting are fully tailored to your data and claims process, evolving with your program.

The APS Advantage

Human-Assisted Detection Technology – Combining machine learning with real-world claims expertise.

Flexible Delivery Models – Available as a stand-alone or integrated within ClaimExpert Direct.

Proven Claims Efficiency – APS services are built to reduce costs, improve adjuster accuracy, and simplify claims management.

How It Works

Analyze – APS ingests claim narratives, demographics, payment behavior, and adjuster notes.

Score – Proprietary algorithms generate a fraud risk score based on 30+ behavioral triggers.

Flag – High-risk claims are flagged for focused adjuster review or SIU escalation.

Refine – Scores evolve with human training, making your detection strategy smarter over time.

Connect with APS to learn more about APS Guardian for Fraud, Waste, and Abuse and how earlier fraud detection can strengthen your claims program.